The physical risks relate to the biological nature of a forestry investment and include such things as natural disasters (fire, wind blow), pests and diseases, animal damage or theft.

In the UK, the risk of fire is generally fairly low. Wind blow is an issue, particularly on the windier west side of the country and harvesting plans should be fine-tuned to minimise this risk.

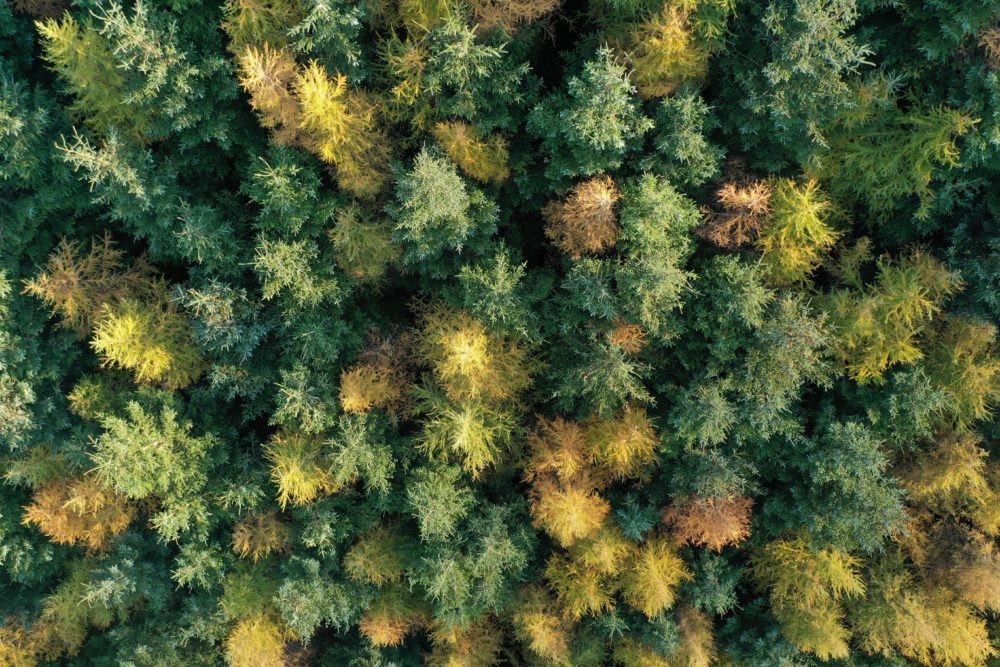

Pests and diseases are becoming more prevalent in commercial crops. In recent years, larch in the UK have been damaged by a serious fungus-like pathogen, Phytophthora ramorum which can kill mature trees. PIne trees have been affected by a fungus Dothistroma septosporum (sometimes called Red Band Needle Blight) which can damage the trees growth.

However, careful attention to species selection at planting (‘the right tree in the right place’) and good silviculture can mitigate this risk.

Young trees can be damaged by deer browsing or through bark stripping by squirrels. Generally, this can be minimised by good attention to fencing or control.

Economic risks include such things as price risk, supply and demand risk, regulatory risk and liquidity risk. In the main, these can be mitigated by good management and planning. For example, harvesting plans can be flexed (within reason) to wait for the best timber prices.

The major economic risk for most investors is overpaying for the property – seeking advice at acquisition is usually a sound investment.